Real estate statistics for the 4th quarter of 2024: inventory starts to dwindle due to key rate cuts

Published on February 11, 2025

The Quebec real estate market saw lots of action in the fourth quarter of 2024, driven by key rate cuts, especially those announced on October 23. These cuts boosted buyer enthusiasm, resulting in strong sales and significant price increases for different property types across the province.

Read all about previous statistics in the Real Estate Minute - 3rd quarter 2024!

Overview:

- Gatineau: a surge in new listings is not enough to meet demand

- Montreal: strong sales growth

- Quebec City: signs of overheating

- Saguenay: a decline in inventory

- Sherbrooke: moderately ramping up

- Trois-Rivières: still one of the hottest markets

- Analyzing trends and looking to the future

Fourth quarter results underscored a trend on the radar since the middle of 2024, a slowdown in new listings combined with a sustained level of sales. An impressive 29% increase in sales was recorded during this period,1 compared to only a 5% increase in the number of new listings.2

These variances directly contributed to a 2% decrease in the inventory of properties for sale compared to last year, and that figure has not budged much in recent months.3 It means that buyers on the hunt for their dream home found even more limited choices on the market.

Unsurprisingly, that has a strong impact on market momentum. The relationship between new listings and sales is revealing ratios not seen since the pandemic. It’s a seller’s market during times like this and their advantage only continues to grow.

Under these circumstances, sales times might have dropped but remained on par with last year’s numbers.4 On average, it took 61 days to sell a single-family home, 64 days for a condominium and 75 days for a multiplex (2-5 units). However, we noted an increase in quick sales among properties listed during this period: indeed nearly a quarter of homeowners who put their property on DuProprio.com received and accepted an offer to purchase within 30 days after listing.5

The median price index has been drastically affected by the increased financial strength that goes hand in hand with lower interest rates and greater competitiveness among buyers. This optimal mix has led to a significant increase in the median selling price across Quebec for all property types.6 Although some indicators suggest the market is overheating, the level of overbidding remained relatively stable for sellers who used DuProprio.com in the fourth quarter of 2024, representing around 15% of residential transactions, up 3% from last year.7

Gatineau: a surge in new listings is not enough to meet demand

The Gatineau Census Metropolitan Area (CMA) is no exception to the trend. The number of new properties available on the market jumped 10%8 but buyers were out in full force and sales were up 26% from last year.9

The increase in listings ensured a bit of an inventory cushion was maintained compared to last year (+4%), despite a sharp 12% drop relating to the third quarter of 2024.10

When you consider the already limited inventory and last quarter’s monthly sales momentum, it’s pretty clear that sellers are setting the tone in this CMA.

Sales times held fast in this region, with an average of 50 days for single-family homes, 53 days for condominiums and 66 days for plexes with 2-5 units.11

Already one of the pricier CMAs, Gatineau recorded a more moderate increase for single-family homes, up 5%. The price of a condominium stayed stable while that of a multiplex grew by 11%.12

Montreal: strong sales growth

The Montreal CMA saw a steady pace of new listings in the first half of the year.13 However, the slowdown observed in the third quarter continued into the last three months of the year, resulting in a 5% drop.13

The number of transactions rose by an impressive 32%, the strongest variation among the six CMAs in this study.14 Subsequently, inventory was down from the previous quarter, shrinking around 3%.15

While the pendulum was predicted to start swinging back, there is no denying that sellers remain firmly in the driver’s seat.

The region continuedto post relatively short sales times. The process took 55 days for a single-family home, 64 days for a condominium and 75 days for a plex with 2-5 units.16

The Montreal CMA is home to some of the highest prices in the province and continued its upward climb over the same period last year. The price of a single-family home rose 8%, a condominium, 7%, and a plex, 9%.17

Quebec City: signs of overheating

Since the start of the year, growth in the availability of new listings in the Quebec City CMA remained relatively stable18 and sales maintained a steady pace.19 The fourth quarter witnessed an even more dramatic contrast— listings only increased by 1%,18 while sales spiked 26%.19

The inventory is still on a downward trend and that means even fewer choices for buyers.20 The region recorded a decrease of 13% compared to the previous quarter and a significant decrease of 32%.20

Quebec City can currently boast of achieving an interesting dynamic with a near perfect 1:1 ratio between new listings and sales. This balanced ratio hasn’t been observed since the market overheated during the pandemic. With such a ratio in effect, it’s clear that sellers are enjoying a considerable advantage over buyers. At this rate, this is the CMA where inventory will run out the fastest without new listings coming on the market.

Average sales times therefore fell compared to the same period last year.21 A single-family home is now negotiated in 43 days, a condominium in 57 days and a plex with 2 to 5 units in 52 days.21 This has cut the selling time down by about a week in the space of a year.21

Additionally, nearly half of the properties listed for sale in the fourth quarter on DuProprio.com were declared sold in less than 30 days, a record among the six metropolitan areas.22

With such a robust market, median prices are also continuing to rise. Single-family homes recorded an increase of 12%, while condominiums recorded an 8% increase and 12% for multiplexes.23

Although a significant increase in bidding wars was not observed province-wide, it was a different story in the Quebec City CMA. Owners who reported selling on DuProprio.com reported being part of a bidding war 29% of the time, an increase of 9% compared with the same period last year.24

Saguenay: a decline in inventory

Since the start of 2024, new listings have been even more scarce than last year, while sales continue to grow.25 A slight 4% increase in new listings was observed in the fourth quarter,25 contrasting with a 22% jump in the number of sales.26

This trend explains the evolution of inventory that recorded a significant 11% decrease compared to the previous quarter and an 18% decrease compared to the same period last year.27 Buyers are finding less and less choice when house hunting.

With an inventory in sharp decline and a steady pace of sales in this and previous quarters, the market is intensifying, putting sellers in an even more advantageous position than before.

In this strong market, the average selling time for a single-family homes dropped by five days compared to the same period last year. 28 As for multiplexes, they recorded a period of 93 days.28 Quick sales were a common sight in the region: 43% of owners who put their property up for sale on DuProprio.com during the fourth quarter found a buyer in less than 30 days.29

Median prices continued to rise with strong increases noted last year.30 The price of a single-family home and condominium jumped 12%, while the multiplex price increased 14%.30

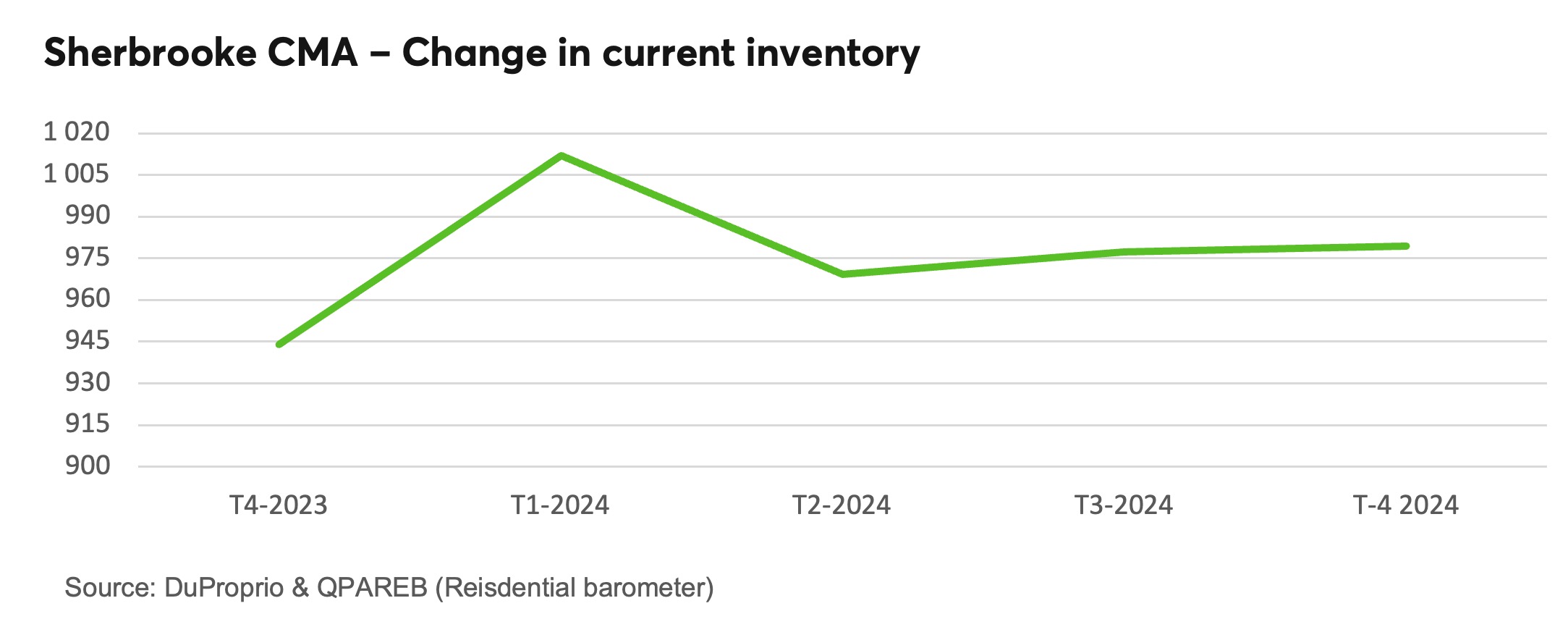

Sherbrooke: moderately ramping up

As seen elsewhere in the province, the Sherbrooke CMA saw a steady stream of new listings in the first half of the year, going hand in hand with increasing sales.31 However, new listings rose only 5% in the fourth quarter, while transactions jumped 27%.32

Despite it all, the region is one of the rare spots where inventory held the line. The average number of properties available to buyers remained stable in the last six months but a slight surplus compared to the same period last year was noted.33

Though some inventory did build up, the growth in the pace of sales has strongly contributed to maintaining and even increasing the seller’s advantage compared to the same period last year.

Average sales times remained similar to last year’s figures for single-family homes and condominiums, 54 and 60 days respectively.34 By contrast, it took 93 days for multiplexes, an increase of 28 days compared to the same period last year.34

It’s also interesting to note that a third of people who used DuProprio.com to sell their property during this period did so in 30 days or less, a result above the provincial norm.35

Although median prices didn’t increase at the same rate as in other CMAs, they continued to grow. Single-family homes rose 10%, condominiums increased 3% and multiplexes 24%, a substantial jump.36 So, despite the fact these property types recorded longer sales times, sellers saw their patience rewarded by a sharp increase in the selling price.

Trois-Rivières: still one of the hottest markets

While the real estate market in the Trois-Rivières CMA has the reputation of being one of the most active in the province, the latest trends point to more continuity than growth. A sharp decline in new listings was reported at the start of 2024 and this limited sales opportunities.37 The fourth quarter witnessed a significant increase in supply compared to last year (+8 %) 37 but sales increased at an even higher rate in such a hot market, recording a 20% increase.38

This jump in the volume of transactions puts a halt to potential inventory inflation in the region. The number of available properties remains unchanged from the previous quarter and is up slightly by 3% compared to the same period last year.39

A faster pace of sales and inventory growth stagnating means the ball is still firmly in the sellers’ court.

You might think that sales times dropped but in fact they have been quietly inching upward. It took on average 42 days to sell a single-family home, 44 days for a condominium and 62 for a multiplex.40

Median prices have remained on an upward trend, especially for single-family homes and condominiums, which recorded increases of 12% and 16% respectively.41 However, although multiplexes also followed the upward trend in the previous three quarters, they only averaged a lowly 1% increase year-over-year.41

Around 16% of transactions on DuProprio.com were sold following a bidding war, on par with the provincial norm for the fourth quarter.

Analyzing trends and looking to the future

Even though previous quarters pointed to a progressive return to balance in many CMAs in Quebec, repeated cuts to the Bank of Canada’s key rate in the fourth quarter have changed the outlook.

Bank of Canada key interest rate

The inventory of properties for sale has never recovered to pre-pandemic levels and continues to decline across the province.3 This setback cancels any progress achieved by several months of modest increases.

In Quebec, 2024 wrapped up with strong market momentum. The full impact of the key rate cut announced on December 11, late in the quarter when the real estate market was already less active, has likely not been fully revealed yet.

The year 2025 might kick off with a continuation of trends observed in the last quarter. That’s currently what we’re seeing among owners who reported selling on DuProprio.com, where sales are up by almost 50% from last year at mid-January.42

DuProprio works! Sell your property and save on commission with the help of our team. Find out more about our visibility and sales support services by scheduling a free consultation or watching our short videos.

Thinking of selling in today’s market?

Planning to buy?