Real estate statistics for the 2nd quarter of 2024: market tension remains high

Published on August 30, 2024

The second quarter continued the momentum from the start of the year, with a notable increase in the supply of new properties and sales, demonstrating that the market is dynamic. Although the inventory of properties for sale increased slightly, it remains historically low, maintaining a market favorable to the selling side. This dynamic contributes to the continued rise in median prices, which are reaching new highs in various markets across the province. Here's how things stand for buyers and sellers.

Read our real estate news section to be in the know!

Summary:

- Gatineau: a little more choice, but not enough

- Montreal: revival and still more expensive

- Québec: signs of overheating

- Saguenay: balance of power still in favor of sellers

- Sherbrooke: new listings not sufficient to meet demand

- Trois-Rivières: demand as strong as ever

- Analyzing trends and looking to the future

Overall, the second quarter was very similar to the first. In 2024, there were more new properties on the market for buyers. The increase is considerable for a second consecutive quarter, this time 12% over last year at this time. However, these new listings are finding takers, with sales up by around 8%1.

Although recent months have succeeded in boosting the inventory of properties for sale on various platforms (including DuProprio.com and those of brokers) by 17% in the second quarter of 2024 compared to 2023, there has only been a 4% increase since the start of the year1. This gives buyers a little more choice.

Supported by the number of transactions in the second quarter, inventory therefore remains at a low level. Considering the pace of sales in relation to this inventory, the market is still in a strong position for owners wishing to put their property up for sale throughout the province of Quebec.

Despite the distinctions between different types of property, the Quebec real estate market remains very dynamic. In fact, 27% of those who reported selling their property on DuProprio.com did so within 30 days of placing their ad online. Overbidding is no exception in the province: 15% of sales reported on DuProprio.com were concluded under such conditions, a threshold similar to that of last year at the same time2.

Average selling times remain very short, with a very slight increase compared to 2023 in the equivalent quarter. Single-family homes sell in an average of 60 days, condominiums in 59 days, and plexes with 2 to 5 units in 79 days3.

The median sale price of properties has risen overall in recent months, and the strength of the market in the second quarter of 2024 will propel several metropolitan areas to new quarterly highs. For example, median prices for single-family homes are peaking at $420,000, up 7% on the same period last year4. Condominiums posted a median price of $374,800, an increase of 4%, while plexes saw one of the strongest increases in value, reaching $525,938, an increase of over 14%4.

Gatineau: a little more choice, but not enough

At the start of 2024, the Gatineau CMA benefited from a substantial number of new listings, with an increase of over 26% in the first quarter of 2024 compared to the same period last year5. The second quarter followed a relatively similar pattern, albeit more in line with the provincial trend, with a 14% increase in new listings5.

At the same time, we saw an 8% increase in real estate transactions6. However, with the supply of properties outstripping demand, the region's inventory of homes for sale continues to grow. The number of properties posted on the main sales platforms rose appreciably, by 35% compared to the same period a year ago6. The increase at the beginning of the year is smaller but still significant, with 20% more choices6.

You might think that the accumulation of inventory could significantly change the real estate situation, but think again. The market remains very active and favors the selling side. When we compare available inventory with the average pace of sales, we see that the market is still strongly in their favor.

Sales times remain fast and among the shortest in the province, with an average of 38 days for the sale of a single-family home, 43 days for condominiums and 61 days for plexes with 2 to 5 units7.

As for prices, they continue to rise, regardless of category. It cost approximately $454,500 (median price) to purchase a single-family home in Gatineau, a 3% increase over last year8. Notable increases were also observed for condominiums, with a median price of $314,000 (+6%) and $504,000 (+7%) for plexes8.

Montreal: revival and still more expensive

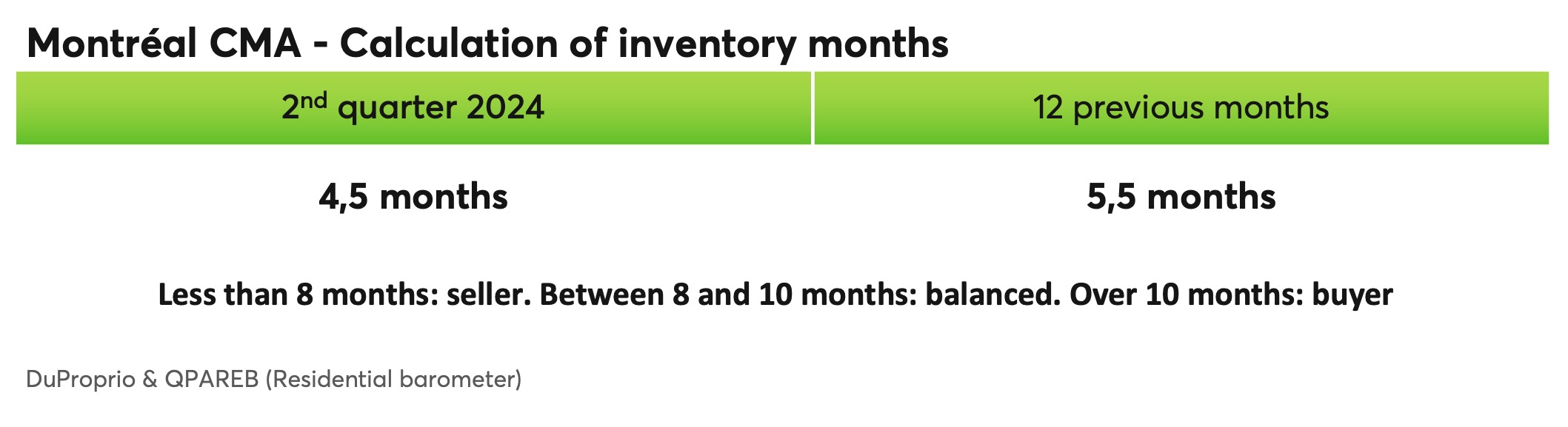

The real estate market in the Montreal CMA had been slowing down for several quarters, but had still not reached equilibrium. For the second quarter, the supply of new properties on the market continued to grow, with a 13% jump over last year9. Many of these new listings found takers, with transactions for the period up by 8%10. As a result, the inventory available to buyers was 15% higher than last year, but only 5% higher than in the first quarter of 202410.

The Montreal real estate market is experiencing a slight revival compared with recent quarters, and is now in line with the provincial average. When we examine the pace of sales in relation to accessible inventory, the results indicate a market favorable to the selling side, almost similar to that of the year 2023 at the same period.

A more detailed analysis also reveals that these results are influenced in particular by the greater intensity of the North Shore real estate market, where the number of sales practically equalled the number of new listings. In fact, the inventory available to buyers in this sector was lower than in the first quarter of the year10.

For the current period, it takes about 54 days to find a buyer for a single-family home in the Montreal region, 59 days for a condominium and 75 days for a 2- to 5-unit plex11.

Given this recovery in the greater urban area, it's not surprising to see median prices setting records: the median price for a single-family home is $559,000, a considerable 7% increase over last year12. Condominiums increased by 3%, reaching a median price of $403,000, while plexes also reached a new high with median prices of $735,000, up over 6% on last year12.

Québec: signs of overheating

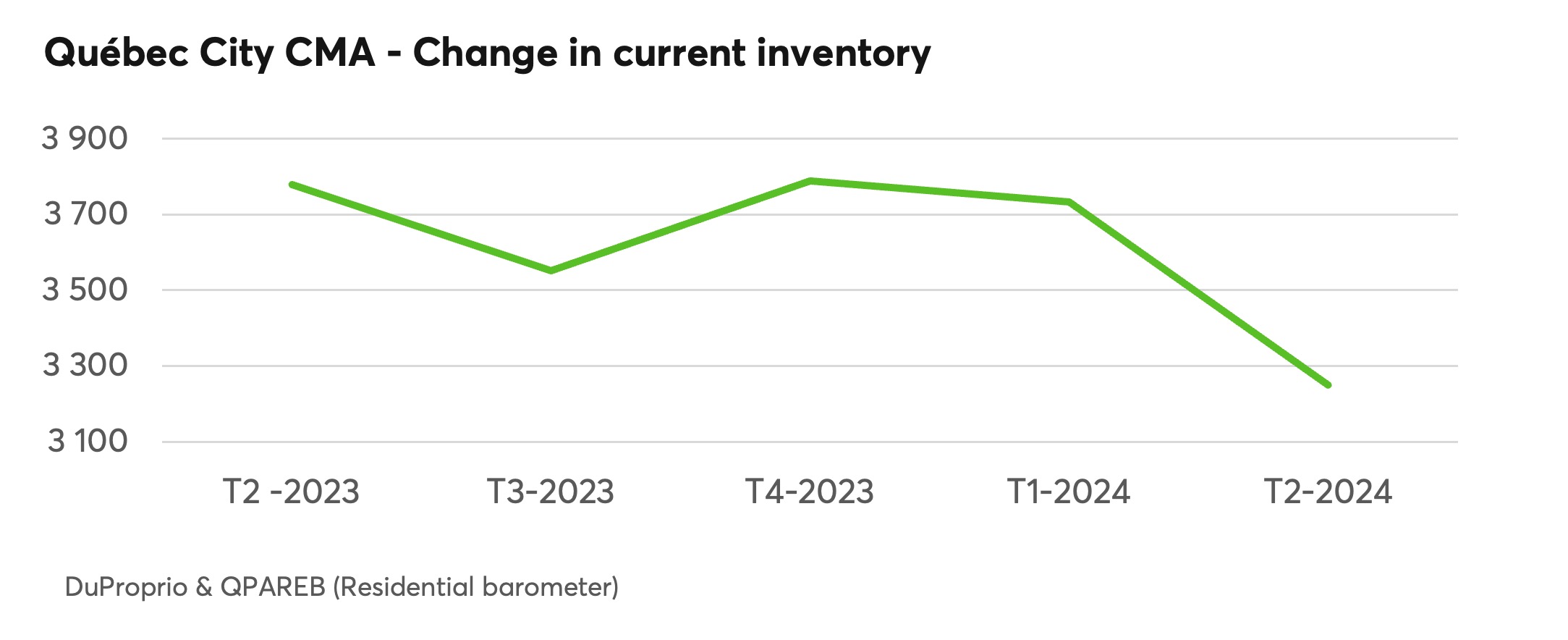

For several quarters now, the Capitale-Nationale region has been showing signs of overheating. The beginning of the year indicated that the market was showing no signs of slowing down, and the second quarter of 2024 ended on that note. Buyers had little to cheer about, despite a slim 2% year-on-year increase in the number of new properties on the market13. This was not enough to meet demand, however, and sales rose in the same direction, by 3%14.

However, it's the inventory of properties on the market that attracts attention: the number of properties available on DuProprio.com and brokerage platforms is down by 14% compared to last year, and by 13% relative to the first quarter of this year13.

Looking at the pace of sales and the proposed inventory for the period, we can see that market dynamics are intensifying in the Quebec City region, clearly showing that the buying side is losing power. The seller's market status is being consolidated beyond any doubt.

In this context, it's not surprising to see strong results among DuProprio customers: nearly 45% of properties reported sold on DuProprio.com were sold in less than 30 days, and 24% of these were sold in the context of an overbid15.

The average time to sell a single-family home was 56 days, while condominiums took 49 days and plexes 64 days16.

Unsurprisingly, there is upward pressure on selling prices for all property types. Single-family homes reached a record high, with a median price of $378,100, a significant 8% increase over last year. Condominiums cost $276,300, up 13%, and plexes $415,000, up 5% on the same quarter last year17.

Saguenay: balance of power still in favor of sellers

For several months now, sellers in the region have been benefiting from a market in their favor. It's against this backdrop that almost the same number of homeowners as at the same time last year have decided to post a “For Sale” sign in front of their home18.

After registering a considerable increase in sales in the first quarter, with a rise of over 15%, the second quarter showed more mixed results, however, with a slight decline of around 5% on the previous period19. This represents only 20 fewer sales in absolute terms19.

The average inventory of properties for sale in the second quarter, reduced by the success of first-quarter sales, continues to be slightly below last year's figure of 3% at the same time18.

Observation of the pace of sales in relation to available inventory during the period shows a market still in favor of the selling party, and a similar measure to last year at the same time. Market strength is above the provincial average.

In this climate, where the balance of power is in the seller's favor, we note that among DuProprio customers, 17% of sales are outbid in the region20.

Sales times are relatively stable compared to last year for single-family homes, with an average of 56 days, one day less than in the second quarter of last year21. For multiplexes, the average was 70 days, down 14 days21.

In a region where prices were considered low compared with the rest of the province, in a market context favorable to sellers, there has been a noticeable catch-up. The median price of a single-family home was $285,000, up 12% on the same date last year, one of the highest increases in Quebec22. Condominiums also experienced similar increases, with a median price of $276,300 (+14%), and plexes with 2 to 5 units reached a median price of $280,000 (+9%)22.

Sherbrooke: new listings not sufficient to meet demand

In the first quarter, we saw an increase of over 22% in new properties coming onto the market23. This trend continued in the second quarter, albeit slightly less markedly, with an increase of around 13%23. Buyers also responded positively, with sales up 10% year-on-year24.

This intense activity on the real estate market led to a significant fluctuation in the average inventory of properties for sale during this period. While this inventory is up sharply by 29% year-on-year in 2023, it is down 5% on the first quarter of 202423. All this to the great dismay of buyers, who find themselves with fewer choices in their searches than at the start of the year23.

Looking at the dynamism of the market as influenced by the pace of sales and available inventory, we can see a slowdown compared with the same period last year. However, this downturn is still far from changing the status of the sector, which remains in favor of the selling side.

In the same vein, 20% of DuProprio customers who reported having sold their property on DuProprio.com did so in an overbid situation, a higher percentage than the provincial average25.

It takes about 58 days to sell a single-family home, 55 for a condominium and 87 days for a plex with 2 to 5 units26.

For the Sherbrooke region, the price index is rising sharply. Median single-family home prices for the quarter reached $392,000, up 7%, setting a new quarterly high. Condominiums posted similar results, with a median price of $310,000, up 6%27. Plexes saw a spectacular 20% increase, reaching a median price of $442,500 compared to the same dates last year27.

Trois-Rivières: demand as strong as ever

For several quarters now, Trois-Rivières has stood out as one of the regions with the most energetic real estate market. The second quarter continues in this direction, putting to rest any notion of a slight slowdown observed at the start of the year.

Contrary to the provincial trend, new listings were scarce and down on last year, by around 17%28. With fewer new offers on the market, transactions were also down, but less significantly, at 3%29.

Although inventory is more generous than at the same time last year, buyers find themselves in virtually the same situation as at the start of the year.

The market remains very dynamic. An analysis of the pace of sales compared with the available inventory indicates a market that is highly favorable to sellers.

The same is true of the sales-to-new-listings ratio used by Canada Mortgage and Housing Corporation (CMHC). A ratio above 70% is a sign of an overheated market. The region ended the quarter with a result of 85%29!

Customers who posted their properties on DuProprio.com benefited from this craze: 24% of owners who reported selling on DuProprio.com did so in an overbid situation, up 4% on last year30.

Among the fastest selling periods in the province, it takes an average of 37 days to declare a single-family home sold, compared with 36 days for condominiums and 44 days for plexes31.

In a market where prices are lower than the Quebec average, vigor continues to drive prices up to catch up. Single-family homes are up sharply, with a 12% jump to a median price of $335,000, a quarterly high for the region32. Condominiums are not to be outdone, posting a median price of $250,500, an increase of 7%32. Plexes also registered a significant increase of 13%, with a median price of $310,000 for the quarter32.

Analyzing trends and looking to the future

Many buyers were expecting mortgage rates to fall during the second quarter. The Bank of Canada finally reduced the key rate by 0.25 points on June 5 and another 0.25 points on July 24, bringing it to 4.50%. These reductions mark the first cuts since the rate was set at 5.00% in September 2023. This first announcement, which came late in the quarter, did not have a significant impact on the period.

Bank of Canada key interest rate

However, buyers didn't stand still when the supply of new properties on the market increased. Transactions followed in droves1, once again consolidating the market to the advantage of the selling side.

This ratio of sales to new listings keeps inventory at historically low levels1 and continues to exert upward pressure on selling prices4. Highs are being reached in all regions of Quebec. A special mention goes to plexes with 2 to 5 units (for both owner-occupiers and investors), which saw a significant rise in value over the period4.

With these trends well-established since the start of the year, the lowering of the key interest rate and a June price index that was down 2.2% on May, it's highly likely that this direction will continue in the coming months.

DuProprio works! Sell your property and save on commission with the help of our team. Find out more about our visibility and sales support services by scheduling a free consultation or watching our short videos.

Thinking of selling in today's market?

Planning to buy?